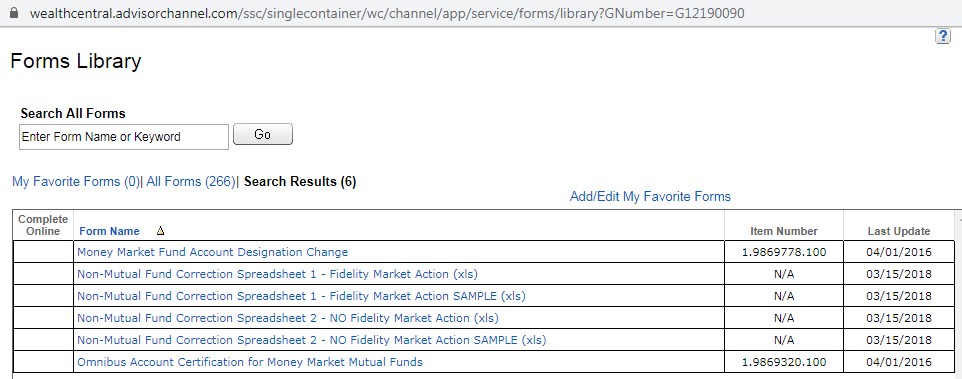

Trade Errors are not part of the daily office routines but something that deserves attention as it may happen to us every once in a while. Our procedures on how to handle these, will be 1st to call back office to notify an error has been committed. Then 2nd to send a Spire Trade Correction Form to Spire Operations through Laserfiche (This form must state what exactly happened and how to correct it). If the correction happened in Fidelity or TD Ameritrade then we would also need to submit a proprietary document that these custodians require called on TD AMERITRADE (ADVISOR TRADE CORRCTION REQUEST FORM) on FIDELITY (TRADE CORRECTION ATTESTATION accompanied by THE PROPRIETARY SPREADSHEET depending on the type of error and if account is required below is the forms library snapshot of the excel spreashet that MUST accompany the fidelity form). For all other custodians, just an email to support@spireip.com should be submitted stating the trade error and that the trade correction form has been submitted.

Moreover, there is no deadline on these occurrences, we all know that these are time sensitive and action is required to protect ourselves from severe losses by immediately notifying Spire operations the minute you know this trade error has occurred. We will keep all these documents as a record of the correction in a compliance file for compliance and regulatory requirements and compliance and regulatory review. Finally, Spire operations finance department will charge your account with the difference (if there is a loss).

Permitted timeframe to submit a trade correction: All trade correction requests (whether due to a failure to place an order, a cancellation of an order, or a cancellation and correction of an existing order) must be submitted to Spire within 30 calendar days of the requested correction date. For example, if the original trade occurred on February 1, a request to correct that trade must be submitted by no later than March 1.

Trade Correction Requests that are greater than 30 days may be considered under certain circumstances, but will require an additional level of Spire back office review and approval. Additionally, these policies apply to all of our advisors, and any 3rd parties they have granted access to place trades within their accounts.

________________________________________________________________________________________________________________________________

Operations to do list:

- Once trade error notification comes into Laserfiche accompanied by proprietary documents from TD/Fidelity (which are the only custodians that require their forms). These must be approved by a series 24and create a duplicate document and move to SpireLF\Internal Operations\Trade Errors.

- Next call Trade Support at appropriate custodian to cover the error in our error account.

- Advisor Submits the documents to the corresponding custodian to move the trade error to our trade error account with that custodian.

- Complete Spire Trade error spreadsheet to document the discrepancy and have a series 24 review and sign it and then scan into Laserfiche pathway: SpireLF\Internal Operations\Trade Errors . (make sure all documents related to each error are filed together).

- Send Finance an email specifying that an error was committed by a particular advisor including the name of the advisor the Spire error account number and the net result of the error either positive or negative.

Comments

0 comments

Please sign in to leave a comment.