Integrated Cashiering Platform is where you go to process money movement.

The application is both very easy to understand and easy to overlook. With that being said, once you are in this system it doesn't matter which account you use to initially open this application as you will need to paste that information in the top right Account # Box if you are creating a transaction or if you are making changes to the accounts features (Standing Instructions or Periodic's). The Banner at the top with multiple Columns will show features on an account (remember the banner is not in the Approvals feed, because the approvals feed is not just one persons account).

When you type in an account (top right box) under the headers inside ICP called Transactions, and Features.The Bar has columns 1. acct # 2. Name 3. Account Registration 4. Product lvl 5. Cash available 6. AMA lvl. (see AMA lvl specifics below) and at the far right of the banner is a (+). The + shows restrictions on the accounts and G numbers associated with each account (both Primary and Secondary's)

Functions of each Header in ICP:

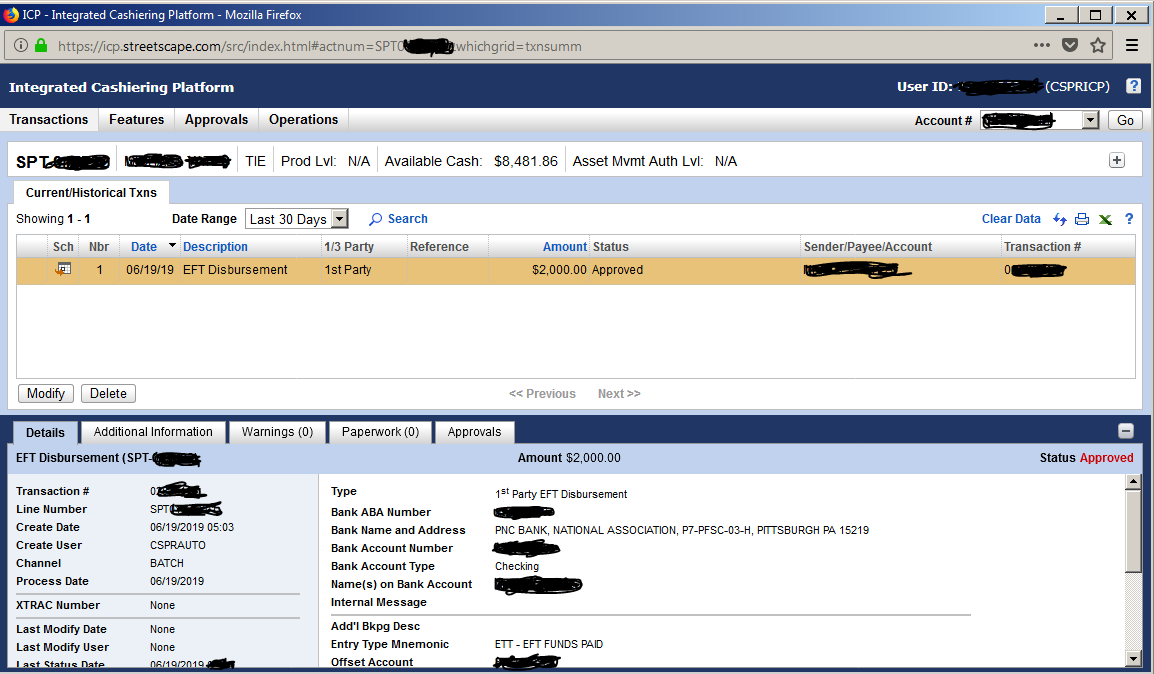

Transactions: In this header the branch administrators and advisors enter their money movement transactions but not standing instructions and periodic plans. We are also able to check the history of transactions on a single account (after entering the account # in the top right rectangular search box).

Features: In this header the periodic plans and standing instructions are set up here. The Branch administrators can set up withdrawals or investment. Under "Details" in the subtab of this picture, you will see a line item that tells you the Valid Date of the standing instructions set up. If that still says Pre-Note then the EFT cannot be done.

Approvals: (Only for Operations Staff) The Approvals will show a Queue of what is waiting our review and final approval. In the initial window there should be rows of transactions for the day that require attention, and in each row when you check the box to start approval, the bottom right row will show a button that will initiate approval process. You are capable of rejecting and having the Branch Administrators re-enter that transaction information. On another note, there are typically more transactions on a daily basis then there are periodic distribution plans being set up or standing instructions. (remember) Toggle between the Types of processed you are approving. Transactions , Standing Instructions , and Periodic Plans. A common practice is too look at the documents in Laserfiche that support this money movement, for compliance and to know how the client communicated this to our advisors.

*Operations: (only for operations associates)Remote Check Deposits are for scanning in received tangible check deposits in the mail into their NFS accounts.

AMA level is only for Retirement accounts and is important for allowing the advisor to determine what needs to be on file to approve transactions.

AMA lvl 1 limited (first party only) this authorizes checks payable to 1st party and addresses on account, and 1st party account transfers and transfers from acct to other same account at NFS which have been pre-authorized through standing instructions paperwork.

AMA lvl 1, adds bank wires to any third party account that has been pre-authorized through standing instructions and transfers to any account at NFS with authorized standing instructions on file. Wires MUST have standing instructions for a WIRE to go out for first and 3rd party.

AMA lvl 2 means Advisor can sign off on transactions to 1st and (not 3rd party) accts inside and outside of NFS from this account with an Attestation). The level 2 allows for 1st party wires, checks, and establish and maintain periodics, but the advisor cannot set up EFT instructions.

*Client will always sign for 3rd party wires

* Wire Costs - If The Advisor wished to incur a Wire fee for their client the Operations team can go into a separate application called FBSI BOLA to Credit the clients account after the wire has been submitted.

*Creating new transactions, Under No Circumstance are advisors or admins permitted to associate wire fees to the Master account. (we must know which advisor is covering the wire fees to allocate those fees appropriately)

For More Information Streetscape has a Hyperlink in their Menu at the bottom called Policies and Procedures, and in the Policies and Procedures Content Section you can choose the sub-tab Cashiering.

Comments

0 comments

Please sign in to leave a comment.